New Social insurance benchmark salary was issued by Beijing Municipal bureau of HR and Social Security on 27 July 2023

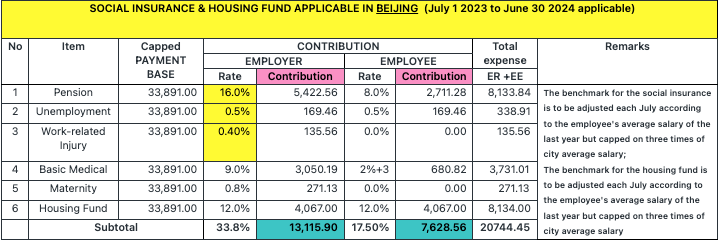

The Beijing Municipal Human Resources and Social Security Bureau and the Beijing Municipal Taxation Bureau of the State Administration of Taxation jointly issued the Notice on Unifying the Upper and Lower Limits of the Salary Base of Various Social Insurance Contributions in 2023, clarifying that from July 2023, the upper limit of the monthly payment base for basic pension, unemployment insurance, work-related injury insurance, and basic medical insurance for employees (including maternity) in the city will be RMB33,891, and the lower limit will be RMB6,326. As a result, commencing from July 1, 2023, if employee’ monthly salary of Beijing exceeds the limit, their total monthly social insurance fees will increase by RMB1,228.44, of which company will increase by RMB776.79 and individuals will increase by RMB451.66

New social insurance and housing fund payment table is as below (commencing from July 01 2023)

VAT reduction policy for small-scale taxpayers extended to FY 2027

VAT exemption for small-scale taxpayers with monthly sales of less than RMB100,000; Small-scale VAT taxpayers are subject to taxable sales income at a rate of 3% minus a rate of 1% to collect VAT; Items subject to a 3% pre-levy rate will be reduced by 1% prepayment of VAT. The policy will be in effect until December 31, 2027.

IIT change

On July 6, 2023, the State Financial Regulatory Administration issued a notice on matters related to the application of preferential policies for commercial health insurance individual income tax products, which will be implemented from August 1, 2023. The policy allows employees to purchase medical insurance, long-term care insurance and sickness insurance to be deducted before salary when calculating taxable income in the current year, with a limit of RMB2,400 per year. It can be deducted annually or on a monthly basis of RMB200 before tax. The insured person can be the employee himself/herself, a spouse, a child or an immediate family member.